Which Insurance for Remote Workers Should You Get?

Health Insurance for Digital Nomads that covers COVID-19

It’s difficult to find global health insurance in normal times, but COVID-19 makes it even more difficult. For most of us, reading about health insurance is not a favorite hobby to begin with. And now COVID-19 has disrupted health systems, government policies and travel advice, finding the right fit is more complicated.

Going and staying abroad involves jumping through hoops, and having health insurance in case something does happen has become more of an issue. Also, some policies limit the time that you’re allowed to spend in your ‘home’ country, even if you don’t consider it your home. COVID-19 has made it even more important to choose insurance that fits your lifestyle.

Some insurance companies, like World Nomads, explicitly do not cover travel to countries that are subject to COVID-19 travel bans. Currently, there are bans in place against travel to most of the world. COVID-19 has disrupted globalism in such a way that many travel companies have gone bankrupt, like STA Travel. Insurance options are more limited than before, but luckily for us digital nomads there a few good options out there.

Starting at 40$/month, Nomad Insurance is a lot less expensive than comparable policies, especially now that it also covers COVID-19. With SafetyWing, the company that offers Nomad Insurance, coverage for COVID-19 works the same as for any other illness. Nomad Insurance can be purchased even just for one month. It is automatically renewed every 28 days until you pick an end-date, which makes it very flexible. A caveat is that you’re only covered for 15-30 days in your home country, depending on where you live.

In case you need more time in your home country, Remote Health is a better option, both for remote individuals and remote teams. At 153$/month you can live and travel anywhere, including unlimited time in your home country. While you can pay monthly, Remote Health is an annual contract. Both Nomad Insurance and Remote Health cover treatment for illness including COVID-19, even in countries with negative travel advice, allowing you to live wherever you please.

The Best Insurance for Digital Nomads

The advice in this article is geared more towards freelancers, as many companies who hire remotely will have insurance policies suited to the lifestyle of their employees. If you’re one of those employees that’s covered by their company – awesome. In case your employer doesn’t know where to start when it comes to insurance, suggest they take a look at the Remote Health package, which is an easy way to cover the whole team. If however, you have to take care of your own safety, this article will help you find the right insurance suited to your lifestyle.

The life of a remote worker is full of adventures. With a flexible schedule and a unique work setup, the remote worker can choose to live life on the go. Settling on an exotic island, living in an exciting metropolis, or traveling from one place to another – the world is your oyster. It may start with opening your laptop in Mexico, next thing you know you’re working from a coffee bar overlooking the central square in Florence or having a lunch break on a beach chair in Bali. Choosing to become a digital nomad means living life to the fullest, with all that it entails.

Once in a while, the digital nomad will encounter some challenges in his or her free lifestyle. When it comes to unexpected incidents, living the free life includes complications. Health care systems vary from country to country. Your worries will be completely different when you’re admitted to a grubby public hospital in Guatemala or when you’re rushed into an exclusive private clinic in Switzerland. Ideally, you want insurance to cover all possible scenarios.

Sudden illness, theft or political climate shifts can quickly drain the bank account of the unprepared. Things can get bad if you find yourself unable to pay for your daily expenses. If withdrawing money or using a credit card is not an option, or if it becomes impossible to get a ticket to go home, you’re in trouble. To avoid this dreadful scenario, it pays to get insurance.

Which Kinds of Insurance for Remote Workers are relevant

For the remote worker, traditional insurance just won’t do. Whereas the usual providers only offer services within a particular country, a digital nomad would need something that works internationally.

Common travel problems, such as lost baggage or a stolen passport, would ideally be covered as well. If you plan to live the nomadic lifestyle or settle in a foreign country for a while, you need something tailored to your situation.

There are several types of insurance to consider:

- Travel Insurance

- Cancellation Cover

- International Medical Insurance

- Health Insurance

- Disability Insurance

- Life Insurance

Travel Insurance

Considering the various kinds of insurance, it can be overwhelming for the typical nomad to combine policies from different providers. Thankfully, there are insurance companies that deliver extensive coverage with just one policy.

If you’ve gone on vacation to a Schengen country, chances are you’ve already obtained a travel insurance policy. This kind of insurance is designed to cover common problems such as cancellations, flight delays, and lost baggage. It’s perfect for the needs of the occasional tourist. Some examples of established travel insurance providers are World Nomads (get a quote here) and IMG.

Often travel insurance covers the following:

- Medical repatriation

- Travel accidents

- Lost and delayed luggage

- Trip cancellation and interruption

- Death overseas

- Travel health

- Stolen baggage (often excluding stolen money)

- Overseas emergency dental

- Protection against assault

- Personal liability

- Overseas medical emergency

Cancellation Cover

COVID-19 urges for more preparation and deliberation pre-trip than ever before. Especially because some countries insist on negative corona tests 72 hours before a trip takes place. What happens in case you need to cancel or interrupt your endeavors abroad, whether it’s a short trip or a multi-year stint, is something to think about.

Traditionally, cancellation cover is part of most travel insurance policies. It is meant to cover the costs in case a trip needs to be canceled or interrupted due to serious causes, such as major injury, death, or the death of a close family member. Usually, it also covers you if you need to travel back to your home country to attend the funeral of a close family member.

Pre-existing conditions are explicitly excluded from this kind of insurance. This means that most insurance companies do not cover cancellation if you’re afraid to travel because of a rise of cases of COVID-19 at your destination or if travel becomes impossible as travel bans increase and government policies are shifting. After all, the spread of COVID-19 is a known pre-existing condition at the moment. Only if you fall seriously ill with COVID-19, it should be covered by traditional cancellation coverage. Some insurance companies have even stopped to offer cancellation cover for new policies.

However, insurance companies are adapting to the spread of the virus in several ways. Sometimes it’s possible to purchase cancellation cover for a small fee with the airline upon purchasing a plane ticket, and airlines are providing more flexibility nowadays. Some insurance companies offer all risk cancellation cover, which often covers cancellation due to any cause, even if you just don’t feel like going abroad anymore. A few travel insurance policies now meet the needs of those who do venture abroad and explicitly do cover COVID-19. SafetyWing’s policies explicitly cover COVID-19.

International Medical Insurance

Long Term Travel Medical Insurance

Unlike more old-fashioned insurance companies that barely cover more than the traditional one-week-per-year annual holiday, SafetyWing promises services catered directly to world travelers and offers a great insurance package for remote workers. They offer travel medical insurance for as little as $40 every 4 weeks. SafetyWing is specially designed for digital nomads who lead an adventurous lifestyle that requires flexibility.

The Nomad Insurance policy of SafetyWing is best paired with existing health insurance from your home country, as coverage in your home country is limited to 15-30 days in a 90-day period. SafetyWing is meant for people living outside their home country for extended periods of time.

SafetyWing Insurance gives coverage for unexpected illness or injury, including eligible expenses for hospitals, doctors or prescription drugs. This means that if you get ill or injured, they will cover eligible medical expenses, but routine checkups and cancer treatment are excluded from the policy. You can find the detailed description here: SafetyWing Coverage

This insurance policy takes care of you in all countries of the world, except Cuba, Iran and North Korea. It can also provide additional coverage for a friend or family member.

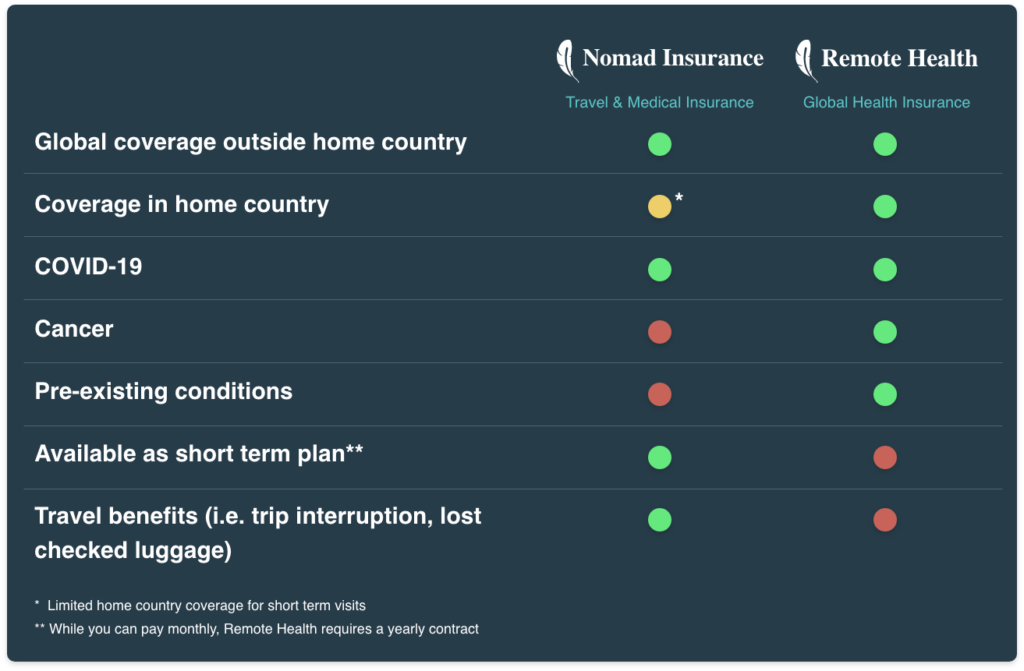

With its extensive coverage and relatively low price, SafetyWing is a good choice for digital nomads and is worth checking out for those leading an international lifestyle. As mentioned, SafetyWing also offers a more comprehensive policy that has customizable add-ons and covers even more. A big difference for digital nomads is that the more comprehensive Remote Health policy covers unlimited time spent in your home country, which makes it easier to deal with the ever-shifting travel advice since COVID-19 came into the world. Also, with coverage of regular doctor check-ups and serious long-term illnesses like cancer, Remote Health is more attractive to those among us that regularly spend several years in other countries. If you happen to have a costly pre-existing condition, it pays off to send SafetyWing an e-mail to see if they can cover it. An overall comparison between Nomad Insurance and Remote Health can be found in the following graphic.

If you’re traveling/living with family and want to go with more traditional insurance companies, some examples of global medical plans are those offered by Aetna, Cigna, Allianz, and Integra Global.

Their policies are similar to travel insurance but are meant for long-term coverage. These plans are suited to ex-pats and ex-pat families. The policy usually covers a year, can be renewed, and comes with a relatively high price tag. Many ex-pats, most of them residing one or two years in one place, are insured by Cigna. To get a quote from these traditional insurance companies, it’s often required to indicate one country where you will be living for the next year. For many digital nomads, this takes the fun out of the game.

These insurance policies offer more comprehensive protection for you and your family if you plan to stay in a foreign country for one year or longer. Also known as international medical insurance, these global medical plans make sure that you will be taken care of abroad even if you are not a citizen of the country you are staying in.

Short Term Travel Insurance

Another kind of insurance policy for the frequent traveler is the regular kind of travel insurance. This kind of insurance is concentrated on health benefits and it provides temporary medical coverage for short trips abroad. This kind of insurance is suited to vacationers, exchange students, and people traveling for a short period of time. It typically covers a maximum of 30 to 90 days per trip abroad. This kind of policy can also be used by remote workers that use their home country as a base to make multiple short trips per year.

Examples of policies that fall under this category are the various plans offered by Tokio Marine and the Voyager plans of GeoBlue. These kinds of policies provide benefits similar to regular travel insurance, plus the following extras:

- In-patient care

- Wellness and preventive measures

- Evacuation

- Dental care

- Vision care

- Access to private healthcare providers

Non-Emergency Health Insurance

While travel insurance covers medical emergencies for digital nomads, access to affordable healthcare also is a concern for freelance homebodies. Thankfully, there are various ways that home-based remote workers can get medical assistance. If your spouse remains employed with a traditional office, you can add yourself as a dependent. This option, however, may not always be the most practical one, as it makes you completely dependent on your spouse.

If you’re based in the USA, an option is to get temporary coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA), which basically extends your coverage from a previous company provided that you pay your own premium. This only works up to 18 months after your departure. Alternatively, you can also get assistance with the Affordable Care Act (ACA, also known as Obamacare) or other subsidized health care programs offered at the Marketplace of Healthcare.gov.

Of course, if you’re rolling in dough, you have other options available to you. When you pay cash for hospital services, for example, you can request for discounts if you summon enough courage to do it. Another option is to register your business and apply for private healthcare.

Lastly, if you just need frequent check-ups, you can ask for a monthly flat rate from doctors. With this setup, you can get as many visits as you like for a monthly fee. Approximately $79 per month is the standard rate for flat-rate visits. How much haggling is tolerated and how far it will get you in terms of discounts, depends on the culture of the country that you’re in.

Disability Insurance for Remote Workers

For the self-employed worker, a day without work means a day without income. Should you lose the capacity to work due to an accident or sickness, there must be something keeps your earnings going. Disability insurance takes care of you in such circumstances. It helps pay the bills when you can’t.

Disability insurance should not be confused with accident insurance. The latter is part of travel insurance and means that you get paid a sum of money if for instance you fall into a volcano in the Philippines and lose half of your body. Accident insurance means that in that case, you will get a certain amount of money, only once. Disability insurance is different in that it covers you for every day that you’re unable to work as you normally would. What you get, depends on the income you received before you became disabled. Also, disability insurance can cover many forms of disability, even psychological. What is covered and how the insurance company will deal with it in case something happens, varies per company.

The terms of disability insurance vary. Some policies provide for partial disability, when you can still work for a few hours per day due to illness recovery or treatments. This coverage ensures that your income remains stable even if you put in limited hours at work.

Long-term disability insurance, meanwhile, protects you and your family when you become permanently disabled. The terms of this policy vary depending on your premium. You can get insured until retirement, but a benefit period running for a few years will already help a lot.

In choosing your disability insurance, consider the waiting period and benefit period of the policies you are considering. The waiting period is the amount of time it will take for the benefits to be given after you become disabled. Higher premiums usually mean shorter waiting periods, such as a month. The benefit period is the amount of time you will be taken care of. The higher the premiums, the longer the benefit periods.

From the perspective of insurance companies, there are various degrees of disability. If you become disabled, there will sometimes be a check to assess the degree of disability. Most insurance companies work with predetermined rates paid for each loss, depending on your income. If you lose one limb, you receive less money than if you lose two limbs.

Disability insurance typically is included in most insurance policies provided by companies. If however, you have to fend for yourself, disability insurance is one of the more expensive policies to get. But it is worth considering because it will provide for you and your family when you can’t. Check out Trupo, a provider that focuses on freelancers, to start you off in your search for this kind of policy.

Life Insurance for Remote Workers

To put it bluntly, life insurance protects your family in case you die. Usually in large corporations, this kind of protection is a standard benefit especially for those who work in dangerous industries.

Freelancers and remote workers, however, have difficulty availing themselves of this protection due to restrictive requirements. Thankfully, Freelancers Union and other advocacy groups fight for these benefits.

Their Term Life Insurance, in particular, allows their members to insure their children for up to $4,000 per child at the cost of $2.52 per month. Their spouses, meanwhile, are eligible for up to 50% of the members’ coverage. The coverage becomes limited once you hit 65, but your spouse remains covered until she or he hits 70.

Find out What Works Best for You

Overall, insurance is something that you shouldn’t miss out on just because you chose the remote worker’s path. Getting a policy as a freelancer might include a few more steps or alternative methods. It’s hard to give general advice, so you will have to do some research to choose a policy that best fits your lifestyle and your budget.

Even though there are services specifically catering to digital nomads like SafetyWing, it’s still best to invest some time and see what works for you.

At the end of the day, you need protection in life as much as the average office worker. Keep yourself healthy and ready for the future with insurance. Choose your policies wisely and you’ll have a bright and worry-free future as a secured freelancer.

Which kind of insurance do you find essential? What do you do to feel safe as a remote worker or do you consciously choose not to have insurance? Let us know in the comments.